The Waive And Stretch: Takeaways From The Last Transactions Before The Season Starts, Assets Under Representation and EPV Update

Welcome back to another edition of The Waive and Stretch Newsletter. A quick shameless plug to note that I am looking to work in basketball in any capacity and would love to connect with anyone in the industry or trying to break in. Please feel free to share this with anyone who you think might find it interesting. Let's get into it!

What Caught My Attention This Week

The Last Gasp Transactions Before The Season Starts

As the 2024/2025 season has already kicked off, I wanted to take a look at the flurry of transaction activity that took place in the final days of the offseason. We saw a myriad of transactions the last couple of days that included rookie extensions, veteran extensions, waivers, and signings as teams worked to finalize the last of their remaining transactional activity before the season began. There were some interesting takeaways from all this activity that I wanted to dive into.

Rookie Extensions

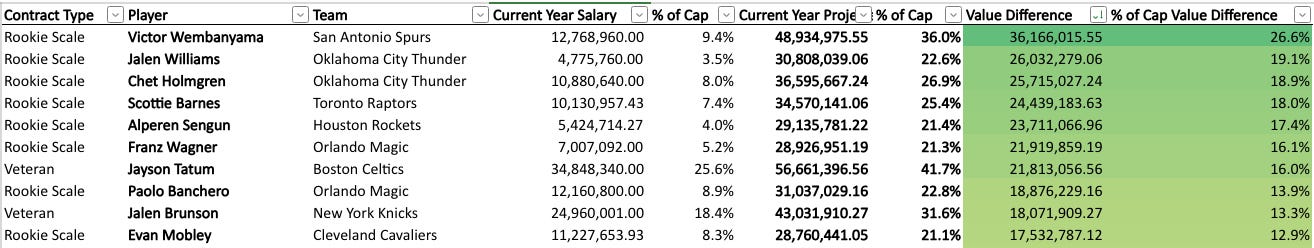

In total, 11 members of the 2021 rookie class agreed on extensions. Here is how they shake out when compared to their projected Estimated Player Value (EPV).

Long-Term Deals: Seven of the 11 extensions were signed for five years. Three of those, Alperen Sengun, Jalen Suggs, and Jalen Johnson, were non-max deals, something that could not have been done in the prior CBA. And of those seven, only Alperen Sengun got a player option, which presumably came with him taking a less-than-max deal. As I’ve written prior, teams should be locking down key rotation players on long-term deals as we head into 10% cap raises for the foreseeable future with the new TV deal. I think that definitely came into play with these extensions, and teams resistance to just hand out player options with these maxes.

Deal Structures: A lot of times, how a team structures the contract can be just as important as the amount of the deal itself, and it can give insight into future plans. Take Jalen Suggs’ five year, $150.5 million extension in Orlando. It is reportedly a descending deal year-over-year, with the highest cap hit in 2025/2026 and lowest in 2029/2030. Because of this, the Magic currently sit ~$11 million into the luxury tax for 2025/2026, past the first apron, as opposed to being right at the tax line if it were an ascending deal. It would seem that the Magic are willing to take a little luxury tax pain in the first two years of the Suggs’ deal (in the second year a presumable Paolo Banchero max would kick in) so that they can have more wiggle room in the out years when both Banchero and Franz Wagner are in the later years of max extensions. Some smart cap planning by the front office in Orlando.

The Wizards kept up their trend of signing descending deals to preserve room in future years with their extension for Corey Kispert, similar to recent deals they negotiated with Kyle Kuzma and Deni Avdija. This, along with Kispert’s team option in the final year, could make him a valuable trade asset over the coming years, just like Avdija was.Interestingly, the Atlanta Hawks are structuring Jalen Johnson’s five year, $150 million as a flat $30 million cap hit every year. They could have preserved more room under next year’s luxury tax by making it ascending, but instead went with the flat amount. This could mean bad news for Clint Capela and Larry Nance Jr, as they already sit ~$19 million below the luxury tax line. I would envision both could become trade candidates this season, which each player should welcome if they want to preserve their bird rights on a team that won’t be hampered by the tax line.

The Houston Rockets and Jalen Green may have agreed to the most interesting rookie extension that I have seen. It’s a three year, $105.3 million extension with a player option in the third year. I think this ended up being a great deal for Green. As I’ve written prior, player positional markets are going to keep getting re-set as we enter this rising cap environment. Its smart for guys like Green to give themselves as many bites at the free agency apple as possible, especially if he isn’t signing a max deal. This gives Green an out in two years, where his max will be $10 million higher than that player option, or he could opt in and be extension-eligible.Future Cap Implications In New Orleans: With the Pelicans and forward Trey Murphy agreeing to a four year, $112 million extension, that leaves the Pelicans with just over $30 million in luxury tax room next season. However, they still have not agreed to any new deal for Brandon Ingram, who will be a free agent this offseason. This Murphy deal could ultimately end up leaving New Orleans having to choose between letting Ingram walk or trading him this offseason, or offloading CJ McCollum’s $30.8 million deal for 2025/2026, unless the team develops a comfortability with a fairly big luxury tax bill next year.

The Death of Incentives: There’s been a lot of hand-wringing over just how punitive these new apron rules are, which is mostly overblown in my opinion. However, it would seem that these rules have brought about the death of incentives in rookie extensions. There were $0 of reported incentives in the 11 rookie extensions that were negotiated. Compare this to last year, where there was ~$29 million in incentives, and the year before that there was ~$51 million. But because all incentives count when it comes to the tax aprons, they could really hamper teams when negotiating the aprons and in future potential trade talks. It would seem we could be in line for a drastic reduction in incentives in new contracts going forward.

Veteran Extensions

We also saw a number of veteran extensions throughout the summer and a flurry of them that came in just before the season started. Here is how they stack up against their EPV.

Minnesota Has Landed The Second Apron Plane: Going back a year and a half ago, I wrote about the coming cap crunch that was going to happen in Minnesota. They were looking at a future of multiple years in the second apron starting this year, 2024/2025. Well, it would appear that between the Karl-Anthony Towns trade and Rudy Goberts extension, Timberwolves have extricated themselves from this luxury tax pain. This Gobert deal really is a win-win for both player and team. First, Minnesota was able to decrease his 2025/2026 cap hit by almost $13 million, giving them a real path to get under the first apron, and potentially under the luxury tax depending on how the player options for Naz Reid and Julius Randle shake out. And Gobert was able to bag an addtional $64 million and a player option for his troubles.

There was another transaction from the Timberwolves that caught my eye that has gone under the radar. They decided to waive Keita Bates-Diop and his guaranted $2.7 million instead of waiving PJ Dozier’s partial guarantee or trading Bates-Diop into someone else’s space, likely at the cost of some cash and draft capital. By eating his money, thats going to result in an almost $15 million luxury tax + salary hit.Aaron Gordon Helps Out Nuggets By Taking Max: Another one of the late but important veteran extensions was Gordon and Denver agreeing to a three year, $103.6 million extension. The key part? Gordon is opting into his 2025/2026 player option of $22.8 million. This likely means the Nuggets will be able to operate under the second apron next year, giving them the ability to aggregate salaries in trades, use the Tax MLE, etc. To compensate Gordon for this, he got the absolute most he possibly could’ve in the three year extension, including a player option for $37 million (18% of cap) in his age 33 season.

Assets Under Representation Update

With rosters set for the start of the season and transactions entering a lull period, I thought it would be a good time to take an updated look at the breakdown of assets under representation across the league by agency. Here are the top ten agencies in assets under representation currently.