The Waive And Stretch: It's Looking Like The NBA Is Going To 3x Their TV Deal

Welcome back to another edition of The Waive and Stretch Newsletter. A quick shameless plug to note that I am looking to work in basketball in any capacity and would love to connect with anyone in the industry or trying to break in. Please feel free to share this Substack with anyone who might find it interesting. Let's get into it!

What Caught My Attention This Week

The NBA Is Starting To Finalize Its New TV Deal

There’s been a lot of recent reporting around the NBAs new TV deal. Bloomberg came out with this story with some specifics around the NBA being close to finalizing an 11-year, $76 billion deal. Wow. It also states that the League has agreed to general frameworks with Walt Disney Co ($2.6 billion a year) and Amazon ($1.8 billion a year), with their third package being decided between Warner Bros Discovery Inc and Comcast, with that deal likely to be at least $2.5 billion a year. Those three deals get you to almost $7 billion a year, compared to the $2.67 billion a year the NBA was getting in its prior deal. The overall package amount is an over 3x increase ($24 billion to $76 billion) but just over a 2.6x increase on an average annual basis, due to the fact that this deal is 2 years longer than the prior deal (11 years vs 9 years). Those 2 years could prove pivotal, however. Imagine the revenue the League would be missing out on if their current deal ran 2 years longer?

Last August I posted on here discussing the impact that the new TV deal will have on the salary cap going forward. You can check that post out here. With this new estimate on the annual average television revenue (~$7 billion), along with a new forecast on the 2024-2025 salary cap ($141,000,000), I was able to put together a new rough estimation on the salary cap going forward. Using these numbers, the new TV deal would have resulted in a non-smoothed cap bump of almost $68 million based on my rough calculations. Because the NBA is implementing a 10% cap, this will result in this jolt to BRI being spread out over multiple salary cap years.

The above assumes a 4.5% growth in the salary cap annually outside of any 25/26 carry-over resulting from the 10% limits. This results in the max cap jumps in the first six years of the new television deal. We’re looking at over $100 million increase in the salary cap from 2023-2024 to 2030-2031, seven years.

Team Vs Player/Agent Takeaways

What should we take from this? This is what I wrote in August from a team perspective:

from a team side, I would try to start locking in guys or as long as possible on new deals or extensions through this period. The salary cap growth is going to outpace any yearly raises on contracts, and so deals are going to get smaller and smaller as a % of the cap as we get deeper into the contracts. And you probably can worry a little less on the $$$ amounts than normal, but should try to fight off the player option as much as you can.

Of the three rookie-scale max extensions that were signed last summer (Anthony Edwards, LaMelo Ball, Tyrese Haliburton), none of them got a player option. Neither did Jaden McDaniels, Devin Vassell, or Desmond Bane, who all signed five year extensions as well.

And from a player/agent perspective:

From an agent/player perspective, it is the complete opposite. New deals are going to keep re-setting market rates as we hit this inflationary environment. Every player’s individual situation is different, but generally I would try to get a player as many bites out of the rising cap apple as possible. Teams are going to have to spend and the tools available to teams to do so has expanded in the new CBA.

As we enter this cap inflationary period, its important to shift the mindset of contracts from dollars to a % of the salary cap, something I’ve been on for a while. If a starting level big makes $15 million this past season, that’s 11% of the salary cap. That equates to $25 million in 2030 based off the table above. That may seem a far way off, but a five year extension signed this summer will take you into that season. The league understood this when they just tagged all exceptions and luxury tax brackets to the growth in the salary cap year-over-year. To help with this mindset shift, every cap sheet on Ducking The Tax has annual salary amounts expressed as a % of the cap.

Impact on Upcoming Rookie Extension Negotiations

The upcoming rookie-scale extension conversations for the class of 2021 is going to be fascinating. Every year of any possible extension will be coming at a time when the cap is consistently growing at a 10% clip, where contracts can only grow at 8%. Will that factor into agents’ discussions with teams? Will we see teams content to settle on some bigger-than-expected deals to fight off player options? I’m can’t wait to see how it shakes out.

Fake Signing Of The Week

Player: Tyrese Maxey

Team: Philadelphia 76ers

Deal: 5 Years Max, $205 million, Player Option

I think Tyrese Maxey proved that he’s worth a max contract offer this offseason. And with the Sixers making him wait so that they can utilize his smaller cap hold this offseason, they should reward him with a player option, which could potentially help make Maxey a lot more money than if he didn’t have one for all the reasons I stated above. If the Sixers try to get cute, I think rival teams would be falling over themselves to sign him to an offer sheet. A 3+1 offer sheet would get Maxey back on the market at least one year earlier, where he could cash in on the rising cap environment quicker. I doubt it gets to that though, and the Sixers max out Maxey drama-free.

Assets Under Representation (AUR) Updates

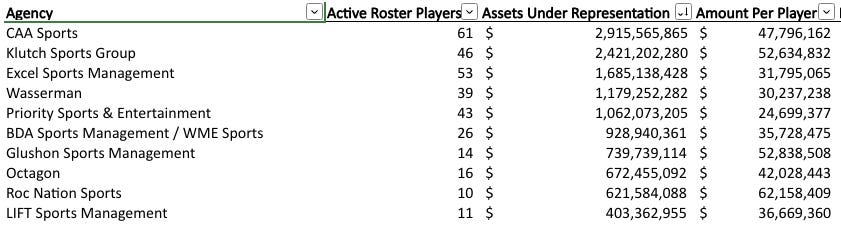

Couple big representation switches recently. Ja Morant has signed with LIFT Sports Management, vaulting them into the top ten in AUR, and Julius Randle has gone back to CAA increasing their lead at the top.